Value, volume of transactions made via InstaPay and PESONet climb at end-Jan.

By: BusinessWorld

Source: businessworld

THE VALUE and volume of electronic fund transfers that went through PESONet and InstaPay continued to rise as of January from a year ago, based on data from the Bangko Sentral ng Pilipinas (BSP).

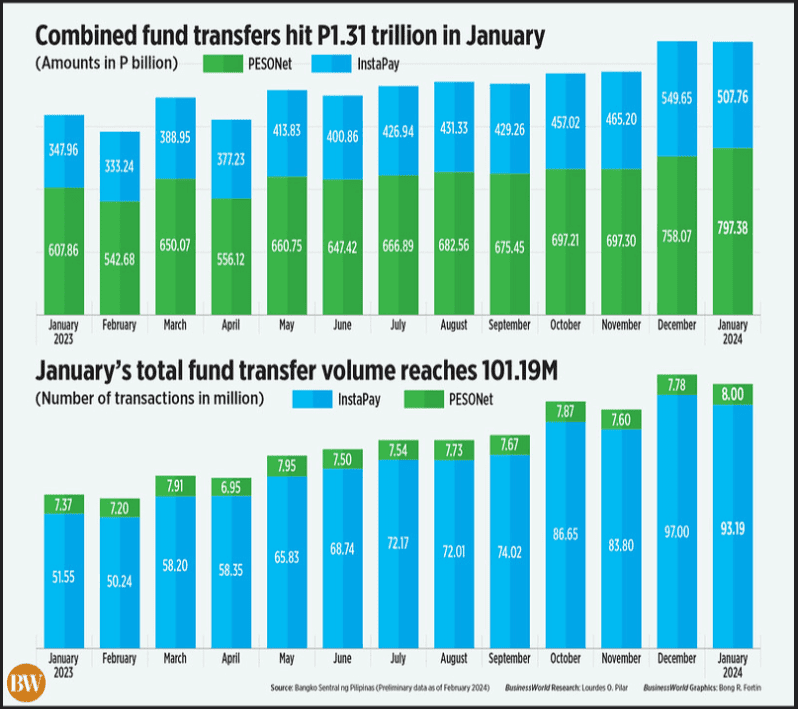

The combined value of transactions done via the BSP’s automated clearing houses InstaPay and PESONet climbed by 36.5% to P1.305 trillion as of January from P955.83 billion in the same period in 2023.

In terms of volume, transactions coursed through InstaPay and PESONet soared by 71.1% to 101.19 million as of end-January from 58.92 million in the comparable year-ago period, the data showed.

The continued high double-digit growth in online fund transfers can be attributed to the robust adoption of digital banking transactions and growth in e-commerce, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

The growth in InstaPay, PESONet transactions also reflect “the greater shift to these electronic fund transfer channels that are faster, cheaper, safer, and more convenient compared to checks, cash, and other over-the-counter bank transactions,” he said.

Broken down, the value of PESONet transactions rose by 31.2% to P797.377 billion as of last month’s end from P607.861 billion as of January 2023.

The volume of transactions coursed through the payment gateway stood at 8 million, 8.5% higher than the 7.37 million seen in the same period last year.

Meanwhile, the value of transactions done through InstaPay climbed by 45.9% year on year to P507.761 billion at end-January from P347.964 billion in the comparable year-ago period.

The volume of InstaPay transactions also surged by 80.8% to 93.19 million from 51.55 million in 2023.

Mr. Ricafort said the expansion in PESONet and InstaPay transactions may also be attributed to the continued recovery of the economy. The Philippine economy grew by 5.6% in 2023, among the fastest in the region.

“This also reflects increased financial sophistication and inclusion of more Filipinos,” he added.

PESONet and InstaPay are automated clearing houses launched in December 2015 under the central bank’s National Retail Payment System.

PESONet caters to high-value transactions and may be considered as an electronic alternative to paper-based checks. On the other hand, InstaPay is a real-time, low-value electronic fund transfer facility for transactions up to P50,000 and is most useful for remittances and e-commerce.

The BSP earlier said it has reached its goal to have 50% of total retail transactions done digitally by end-2023. It is currently working on the next phase of the 2024-2026 Digital Payments Transformation Roadmap. — Keisha B. Ta-asan