-

May 08 2024 SEC to Introduce Cryptocurrencies Framework to Safeguard Traders’ Interests

By: FintechNews

Source: fintechnews

he Philippines Securities and Exchange Commission (SEC) is gearing up to introduce a regulatory framework for cryptocurrencies and their trading activities in the latter half of this year.This development was recently disclosed by the SEC’s chairman, Emilio B. Aquino, with the aim to protect the interests of Filipino cryptocurrency traders.

A move towards a…

-

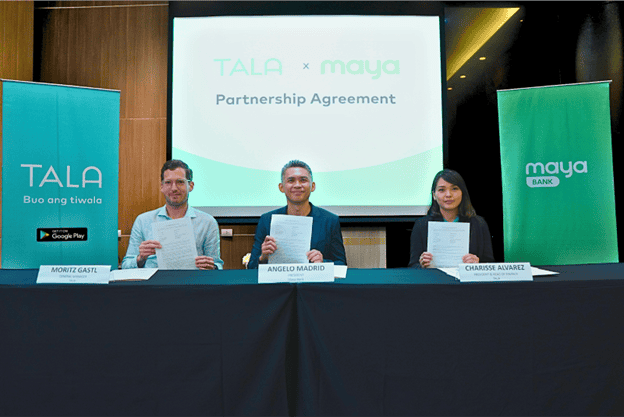

May 07 2024 PARTNERSHIP ANNOUNCEMENT: Tala and Maya Empower Filipinos with $48.5 Million in Loans

Digital financial services app Tala has teamed up with leading digital bank Maya to secure $48.5 million in loans for Filipino customers, particularly targeting the Global Majority.Tala’s President and Head of Finance, Cha Alvarez, emphasized their shared mission: “ mission is to unleash the economic power of the Global Majority, which we will continue to…

-

May 06 2024 Banks given a year to comply with sustainable finance rules

By: BusinessWorld

Source: businessworld

TBILISI, Georgia—The Bangko Sentral ng Pilipinas (BSP) is not keen on imposing immediate sanctions on banks that will fail to comply to the Sustainable Finance Taxonomy Guidelines (SFTG).BSP Deputy Governor Chuchi G. Fonacier told reporters at the sidelines of the 57th Asian Development Bank (ADB) Annual Meeting that the guidelines is a living…

-

May 03 2024 More Filipinos tap BNPL services as credit access remains limited

By: BusinessWorld

Source: businessworld

THE USE of buy now, pay later (BNPL) services among Filipinos increased in the first quarter from the previous year amid limited access to credit and lending products, according to a study by TransUnion.TransUnion’s Consumer Pulse Study showed that among the Filipino respondents who said they have heard of BNPL, which was at…

-

May 02 2024 Closing The Financial Access Gap: Top Fintech Players Leap Further Towards Financial Inclusion With an Industry-Leading Partnership

By: PRWeb

Source: prweb

Tala establishes a $48.5 million loan channeling partnership (LCP) with Maya Bank to increase Filipinos’ access to financial servicesSANTA MONICA, Calif., April 24, 2024 /PRNewswire-PRWeb/ — Tala, the world’s first fintech company for the Global Majority, this week announced its partnership with Maya Bank, the digital bank leader in the Philippines, marking a significant milestone towards bridging the…

-

Apr 29 2024 BillEase Credit Facility Grows to US$40M with New Saison International Investment

By: FintechNews

Source: fintechnews

Buy now, pay later (BNPL) BillEase has received a US$5 million capital injection from Saison Investment Management Private Limited (SIMPL), the offshore lending arm of Saison International Pte. Ltd.

This investment forms part of an expansion that has increased the credit facility of BillEase to US$40 million, overseen by Helicap and supported by a…

-

Apr 24 2024 Investors poured over $700 million into Philippine digital banks

By: Philstar

Source: philstarThe Digital Bank Association of the Philippines (DiBA PH) said the country’s six digital banks have attracted significant capital since 2021.

MANILA, Philippines — Global and local investors have poured over $700 million (around P40 billion) into the country’s digital banking sector to support the industry’s growth and potential to reshape the online financial…

-

Apr 22 2024 Another money changer gets license revoked by BSP

By: Philstar

Source: philstarIn a circular letter signed by BSP Deputy Governor Chuchi Fonacier, the regulator said the Monetary Board has cancelled the certificate of registration of Nikko Mart to operate as a remittance and transfer company with money changing and foreign exchange dealing services for serious violation of its deed of undertaking.

MANILA, Philippines — The…

-

Apr 18 2024 PHL gains World Bank’s help in digitalization bid

By: BusinessMirror

Source: businessmirrorTHE World Bank (WB) expressed its support for the Philippine government’s digitalization program to enhance tax administration, assist in the energy and agriculture sectors and facilitate investments in human capital.

A statement issued by the Department of Finance (DOF) last Wednesday announced that Finance Secretary Ralph G. Recto secured the assistance of the World…

-

Apr 17 2024 BSP looking into BPI downtime

By: BusinessWorld

Source: businessworldTHE BANGKO Sentral ng Pilipinas (BSP) is looking into the unscheduled service disruption experienced by clients of Bank of the Philippine Islands (BPI) on Tuesday, a senior official said.

“At this point, the BSP is looking at the root cause of this occurrence,” BSP Deputy Governor Chuchi G. Fonacier said in a Viber message…