Breaking Down Digital Banking Products in the Philippines

By: FintechNews

Source: fintechnews

D

igital banking has swiftly expanded across Asia, notably achieving reasonable success in nations such as South Korea, China, and Japan. Within Southeast Asia’s digital banking sector, the Philippines joined Singapore as early adopters of digital bank products and services amid a surge in demand for digital transactions in the last few years, serving the nation’s predominantly unbanked populace.

A 2019 report from the Bangko Sentral ng Pilipinas (BSP) noted that 70% of Filipinos were without bank accounts. Additionally, a decline in cheque and ATM usage coupled with an increase in digital transactions was observed in 2020, according to the BSP.

In response to the urgent need for digitalisation, the BSP introduced Circular No. 1105 titled “The Guidelines on the Establishment of Digital Banks” in 2020, permitting the application for official digital bank licences. The central bank’s goal is to digitalise 50% of transactions and motivate at least 70% of Filipinos to establish their own financial accounts by the year 2023.

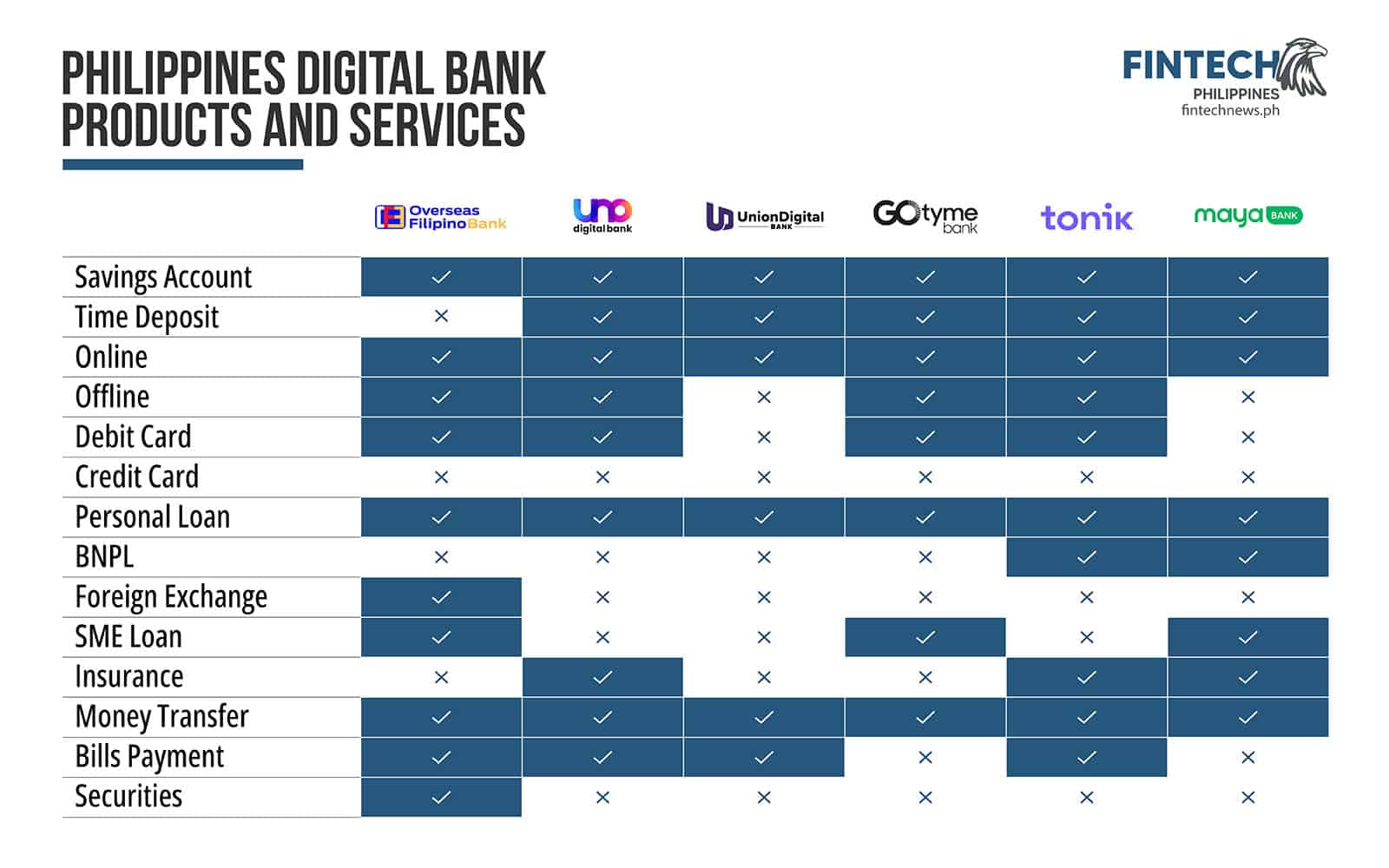

What are the expected products and services offered by the digital native banks in the Philippines? Source: Fintech News Philippines

Moreover, the BSP limited the number of digital bank licences to six, revising down from an initially planned seven, and has paused the acceptance of new digital banking licence applications until end-2024 presently, to sustain competition among emerging digibanks. Upon issuing the digital bank establishment guidelines, the central bank provided a distinct categorisation to enhance the digital banking sector’s provision of financial products and services to customers.

BSP Circular No. 1105, authorised by then BSP Governor Benjamin E. Diokno in December 2020, delineates a digital bank as an entity delivering financial products and services via digital and electronic channels sans physical branches. Current BSP Governor Eli Remolona Jr. has acknowledged that there are many groups, both foreign and local, that have expressed interest in operating a digital bank in the Philippines — but says the lifting of the moratorium will greatly depend on the health and business sufficiency of the present six digibanks.

Under these guidelines, digital banks are authorised to offer loans, accept savings and time deposits as well as foreign currency deposits, invest in securities, provide e-money products and credit cards, market micro-insurance products, and engage in the buying and selling of foreign exchange currencies, among other services.

Now at least a year into full operations with each digital bank accessible via at least a mobile app, here’s a look at the products and services each is offering in the Philippines.

Tonik

Tonik Digital Bank Inc., commonly known as Tonik, launched in the Philippines in 2021. Its consumer products range from deposits, payments, debit cards, and loan offerings for individuals that was recently upgraded to service SMEs.

The Tonik Account is its main savings account with 1% savings rate per annum. As is pretty standard with regional digital banks. customers can also elect to save in goals-based savings ‘pockets’, which Tonik calls Stashes. Opting for a one-person Solo Stash can generate 4% interest per annum, while saving with family and friends in a Group Stash towards a mutual goal (a family holiday, for instance) can incur 4.5% interest annually. The digital pure-play recently unveiled ‘Luv Stash’, savings goals with 4.5% interest rate for couples.

Users can also elect for time deposits, which only pay out once they reach a pre-determined maturity period. This is where the most attractive 6% interest p.a. can be gained. Tonik issues a free “virtual debit card” with every account opened, but a physical debit card can be requested in-app for a fee.

Besides savings, Tonik now offers both microloans of up to PHP 20,000 on flexible repayment terms, as well as buy now, pay later (BNPL) terms of up to PHP 100,000 at partner stores, with a minimum 10% downpayment on a fixed monthly interest rate of 4.5%.

OFBank

State-owned Overseas Filipino Bank (OFBank) was actually the first to secure the BSP’s digital bank license, but took slightly longer to come to market as its license differs from other digital-only banks or neobanks, who are operating under a rural banking license which adhere to a different set of rules.

Since commencing its banking operations in June 2020, the Land Bank of the Philippines (LANDBANK)-owned digital bank has gone on to introduce a wider array of products and services. Part of this might be due to its unique positioning, as it doesn’t target consumers or businesses, but instead overseas-based Filipinos to fulfil their local banking and remittance needs.

To that end, overseas Filipinos can remit funds via a few ways, including GCash or Paymaya e-wallet direct transfers, Visa Direct, from overseas remittance centers. or from a foreign bank account. OFBank is aiming to cater to accessible savings and digital loan needs of overseas Filipinos, including offering Visa debit cards linked to Peso savings accounts.

OFBank also offers lending programmes for overseas Filipinos looking to reintegrate in the Philippines, as well as business financing for “capital building or operational expansion”, facilitated by its parent LANDBANK. OFBank is also the only one from the current digital banking players in the Philippines to offer securities investment among its products, with the ability to invest in top government bonds and treasury securities — again enabled by LANDBANK.

UNO Digital Bank

Meanwhile, digitally native UNO Digital Bank has also established strategic partnerships to grow its products footprint, highlighting collaborations with the likes of GCash, Trusting Social, and Brankas. Brankas is powering the capacity to send funds from UNO savings account to universal banks like UnionBank and Bank of the Philippine Islands (BPI), while Paynamics is enabling a network of physical and virtual topup channels, including 711 and True Money.

Additionally, Bayad is providing bill payment capabilities including for water, telecommunications, and power, among others. Like several of its digital brethren, UNO has a physical debit card issued by Mastercard. Alongside these, UNO has the staple digital bank products including savings account with attractive 4.25% interest p.a. that is credited daily, time deposits with interest rate of up to 6.50% p.a., and personal loans up to PHP 200,000 with low 1.79% interest rates.

UnionDigital Bank

Meanwhile, digitally native UNO Digital Bank has also established strategic partnerships to grow its products footprint, highlighting collaborations with the likes of GCash, Trusting Social, and Brankas. Brankas is powering the capacity to send funds from UNO savings account to universal banks like UnionBank and Bank of the Philippine Islands (BPI), while Paynamics is enabling a network of physical and virtual topup channels, including 711 and True Money.

Additionally, Bayad is providing bill payment capabilities including for water, telecommunications, and power, among others. Like several of its digital brethren, UNO has a physical debit card issued by Mastercard. Alongside these, UNO has the staple digital bank products including savings account with attractive 4.25% interest p.a. that is credited daily, time deposits with interest rate of up to 6.50% p.a., and personal loans up to PHP 200,000 with low 1.79% interest rates.

GoTyme Bank

Unlike the others, GoTyme has the unique positioning of over 200 physical kiosks that function as its physical touchpoints, enabling accelerated savings account openings and even issuing free physical debit cards within five minutes, according to the bank’s co-CEOs. Fund transfers between GoTyme accounts are free, but so are interbank transfers up to three times a week, which is not common.

GoTyme offers a flat 4% p.a. interest rate for its savings account, as well as the ability to create up to five separate, goals-based savings pockets called Go Save accounts. And via a partnership with payment gateway PayMongo, GoTyme can now enhance access to small and medium-sized enterprise (SME) loans for up to PHP 500,000.

Maya Bank

Maya Bank is the digital banking arm of Voyager Innovations, launching alongside the Maya e-wallet at the same time it rebranded from PayMaya. Maya Savings, powered by Maya Bank, Inc., offers retail customers savings with an interest rate of 4.5% per annum. During its launch, Maya Savings gave an introductory interest rate of 6% p.a. to early-bird registrants.

For Maya Savings accounts that have PHP 100,000 deposited, they will be eligible for a 14% p.a. daily interest rate, while the Time Deposit Plus accounts offer a guaranteed 3.5% p.a. that can up to 6% p.a. when the target maturity date and amount are achieved. Maya Bank’s goal-based savings product also offers between 4% and 6% interest p.a., but on a monthly basis.

Maya Bank also provides a business deposit account, which can perform real-time transfers using PesoNet and InstaPay, at a business deposit interest rate of 2.5%. which the digital bank says is 20-25x higher than what traditional banks offer in the Philippines. Maya further offers personal loan and credit lines, with much lower requirements for personal credit, while personal loan requirements are slightly more stringent, but can qualify customers for up to PHP 250,000 instead of the maximum PHP 30,000 for the credit line.

Maya Bank was also one of only two in the Philippines digital banking sector to offer BNPL products, called Maya Pay in 4, where users can pay in four equal instalments for purchased items from participating merchants. However, the digital bank says it has paused this product for the time being, but is slated to return in the future.